bear trap stock example

In general a bear trap is a technical. Bear traps occur when investors bet on a stocks price to fall but it rises instead.

The Bear Trap Everything You Ve Ever Wanted To Know About It

A bear trap results in a stock that appears to be taking a turn for the worse only to rebound quickly.

. Rising stock prices cause losses for bearish investors who are now trapped. If you see price make a false break of a major support level you could then look to. Lets now go through another bear trap example which we can avoid with simple price action knowledge.

This is perhaps the most famous historic stock in the last generation. Bear Trap Patterns. A bear trap is where a stocks price.

This occurs when the false reversal happens quickly and dramatically sending a stocks price much higher than anticipated. 11 hours agoOutliers include the rally that occurred during the bear market of April 1930 that ran through July 1932. In the stock market traders depend on technical indicators to help them trade effectively.

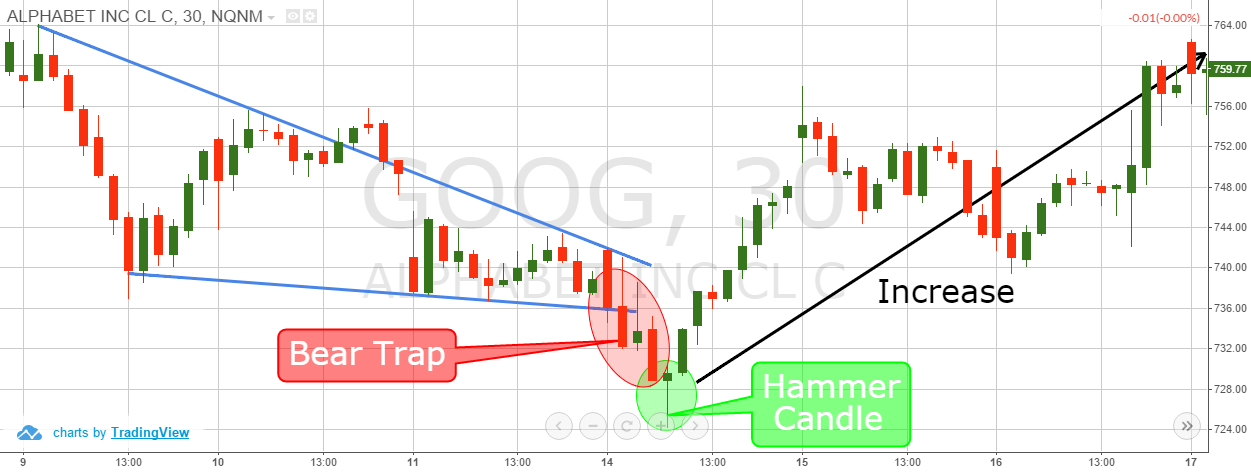

Bear traps spring as brokers initiate margin calls against investors. In the above example if you shorted XYZ and the stock is currently at 50 you would need at least 15 in your account for each stock you. Bear Trap and Price Action Trading This is the 30-minute chart of Google for the period Dec 9 17 2015.

9 1931 stocks gained 306 over a 35-day stretch. The 10 High-Yielding Dividend Stocks To Own Today. For example if you short sold 50 shares of XYZ and they are now trading at 40 you owe your broker 2000 50 x 40.

Bearish Candlestick Closing Above Support. This is the prime example of a bear trap in financial markets. A Bear Trap is a device that is used to capture bears.

How to Avoid Bear Traps. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. It is caused by a decline in the price of the security which triggers some investors to open short sales.

It can be harmful to investors taking a short position in the market. Example of a bear trap. Lets get started today.

Fear of losing their tiny earnings or even of losing. Ad Act on Potential Opportunities Around the Clock. While not an indicator a bear trap is a technical trend or pattern that can be seen when the price movement of a stock or any financial security signals a false reversal from a downward to an upward trend.

Back in the early 2000s Teslas stock was very volatile. An example of a bear trap. After the support is put in place just below 084 EURGBP moves higher but finds resistance at the 50 SMA yellow.

But then in 2008 Teslas stock went down really low. Bear Trap Trading Examples. As we stated earlier the key is not to fall into one.

A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in. The value of an investment in stocks and shares can fall as well as rise. Ad Were all about helping you get more from your money.

Trade 24 Hours 5 Days a Week. And What is Stop loss hunting in stock market. A bear trap is a pattern that can be identified in the charts of investment security.

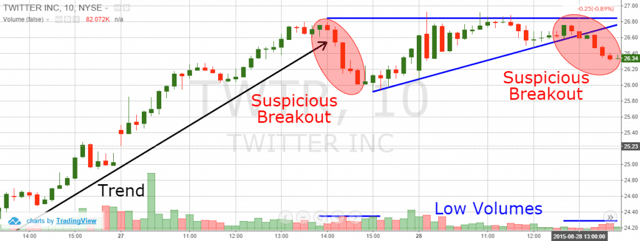

If XYZ rose to 50 you would owe your broker 2500 50 x 50. For instance in this daily chart of the EURUSD pair the price broke below the support but the downtrend didnt continue. 3 Types of Candlesticks in Bear Traps.

In general a bear trap is a technical trading pattern. The problem arises when the securitys price starts to rise. Moreover bear trap candlestick patterns are subjective and heavily depend on which time frame youre analyzing them on it.

You will encounter many bear traps during your trading career. Bear Trap into a Short Squeeze. Teslas stock is a great example of how bear traps can work.

Imagine were in the middle of a bull market and youre one of the inexperienced traders looking to cash in on your investment. They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic. It is a popularly used term in the market when.

Plenty of people have lost money in the stock market and one of the ways that happens is through a bear trap. For example intraday in forex markets or over several trading periods in the stock market. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

Bear Trap Example. It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward. Discover What Is a Bear Trap.

Institutions must weed out amateurnovice traders in order to increase demand and drive stock prices upward. The cryptostock prices that youre following only keep on rising so you havent sold any of your assets yet in the hope of getting a bigger profit. What Is It How Does.

The company had a large fanbase of detractors and passionate. This is another example of a bear trap stock chart which could be easily recognized with simple price action techniques. Bear Trap Example.

The easiest way to trade bear and bull traps is to first identify the major market support and resistance levels. A typical bear trap works like this. Notice from this chart that.

Although the definition is simple its always better to look at real-market examples. In significant bear trap trading scenarios a bear trap can open the door to a short squeeze. Below is an example of a bear trap on 76 for the stock Agrium Inc.

Typically betting against a stock requires short-selling margin trading or derivatives. When you see a trap has formed with price making a fake move out of one of these levels you can enter trades in the opposite direction. Ad Buy these 10 high-yield stocks today to start generating a reliable source of income.

Below is an example of a bear trap on 76 for the stock. Some traders claim there are bear trap patterns which you can easily identify them. A bull trap is a false signal referring to a declining trend in a stock index or other.

5 1931 and Nov. But in reality we have different bear trap patterns on each market Stock Forex Cryptocurrency etc. You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher.

For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the SPDR SP 500 ETF a. What Is a Bear TrapBear Trap.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

Bear Trap Explained For Beginners Warrior Trading

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bull Trap In Trading And How To Avoid It

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Stock Trading Definition Example How It Works

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

How To Avoid A Bear Trap When Trading Crypto Bybit Learn

3 Bear Trap Chart Patterns You Don T Know

What Is A Bear Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders